Don't Wait to Give, Give Today

Most people plan to give someday—whether it’s to their kids, a cause they care about, or their local community. But here’s a thought: what if you didn’t wait?

Planning > A Plan

Forget Set-It-and-Forget-It. Life doesn’t stand still—and neither should your financial plan. As your life changes, adapt your plan to keep you moving toward your goals.

Simple > Complex

Avoid over complicating things where you can. There is enough complexity in our finances let alone our lives to add anymore than we have to.

Agile = Robust

Life is unpredictable, and your financial plan should be ready for it. Embracing flexibility and refining your plan as life changes, helps you adapt and thrive—without relying on guesswork.

Focus

There’s a lot in life—and in finance—that’s out of our hands. But real success happens when we focus on the things we can control, one intentional decision at a time.

Planning centered on Living Your Life

Cash Flow Planning

Risk Management

Proactive Tax Planning

Benefits Optimization

Retirement Income

Retirement Planning

Estate Planning

Education Savings

Investments

It’s easy to get swept up in what the world says you should do with your money. But what if that’s taking you further from the life you actually want?

Not what you should want. Not what someone else says is smart. What feels right for you?

Whether that’s more time with your family, more freedom in your schedule, or just less stress when you want to spend on things you've saved decades for—your money should support that.

We help you get clear on what matters most, and build a real financial plan that’s actually designed around that, not lazy cookie-cutter benchmarks. It’s about building a plan that actually reflects your life—the one you want to live...

No pressure. Just a conversation.

We like to keep things simple. We charge simple, upfront fees so you always know exactly what you are paying. All for a comprehensive financial service. For clients with assets over our cap it works out to much less than many advisors that provide just investment management.

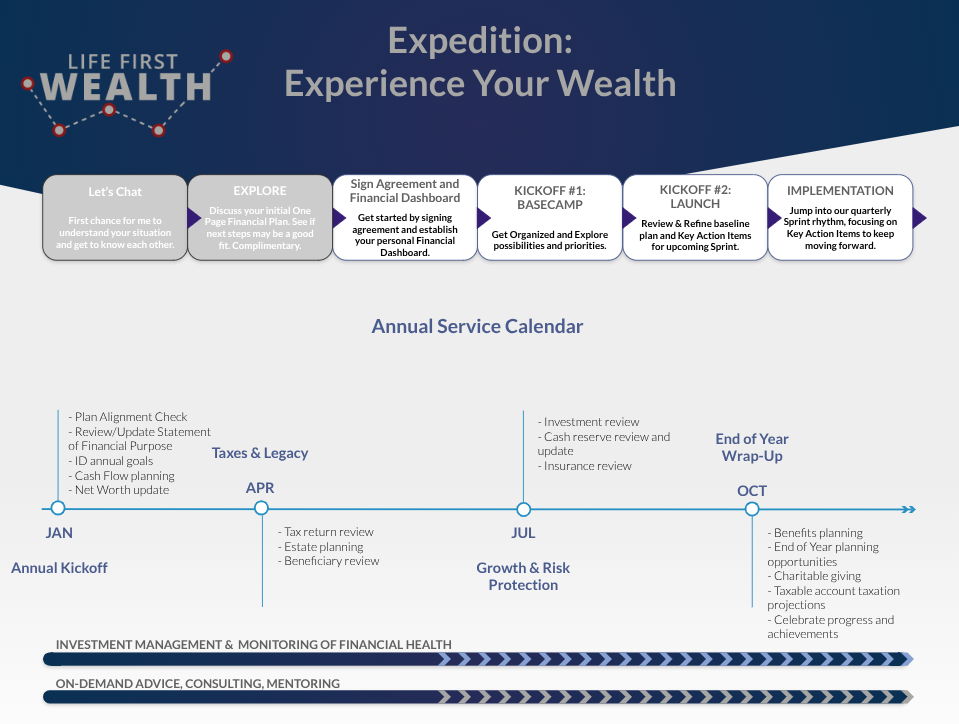

Life doesn’t follow a script, and your financial plan shouldn’t either. That’s why we check in with you every quarter. These regular conversations help us stay in sync with what’s going on in your life—whether it’s a big move, a job change, transitioning to retirement, or something totally unexpected. We adjust your plan as life happens, so you always know where things stand and what’s next. These regular updates help us fine-tune your plan so it keeps up with your life, not the other way around.

Most people plan to give someday—whether it’s to their kids, a cause they care about, or their local community. But here’s a thought: what if you didn’t wait?

If you could only pass on, share, two of these four which would it be? Financial, Human, Intellectual, or Community.

With an ESOP you've got a great opportunity to build serious wealth. It can be a definite game-changer, but...make sure you understand how it really works and how it can fit in your big picture.

Located in Huntsville, AL (aka Rocket City), but serve clients across the country. We meet our clients virtually via phone or video chat. In fact, we have found that even local clients often prefer meeting via phone/video to better fit their busy lives.

We use modern technology to maximize convenience and security. Digital account access, virtual communication, and cloud-based portals help you manage your finances quickly and easily no matter where you are.