Planning for Real Life

We deeply believe in the power of real financial planning to help people achieve their best unique lives. That starts with a few foundational concepts.

- Your Story, Life First. Everyone's vision of a life well-lived is unique to them. Together we explore what that vision looks like and develop your own Statement of Financial Purpose (a 1-2 sentence statement to speaks to what the point of the money is in the first place that acts a North Star as the world moves). By Life First we mean that life is what really matters not some arbitrary number at the bottom of a balance sheet, but how we get to live our lives in our journey. And that goes way beyond our finances from relationships, health, and time.

- Integrated Money. Money is integrated into our entire lives and money is a tool to be used by you to live that life so the planning process must meet that need by integrating all the pieces together as well. We treat your financial life as an integration of lots of different areas that have to work together in order to make the most of it: cash flow, retirement, taxes, estate, insurance, investments, education, etc.

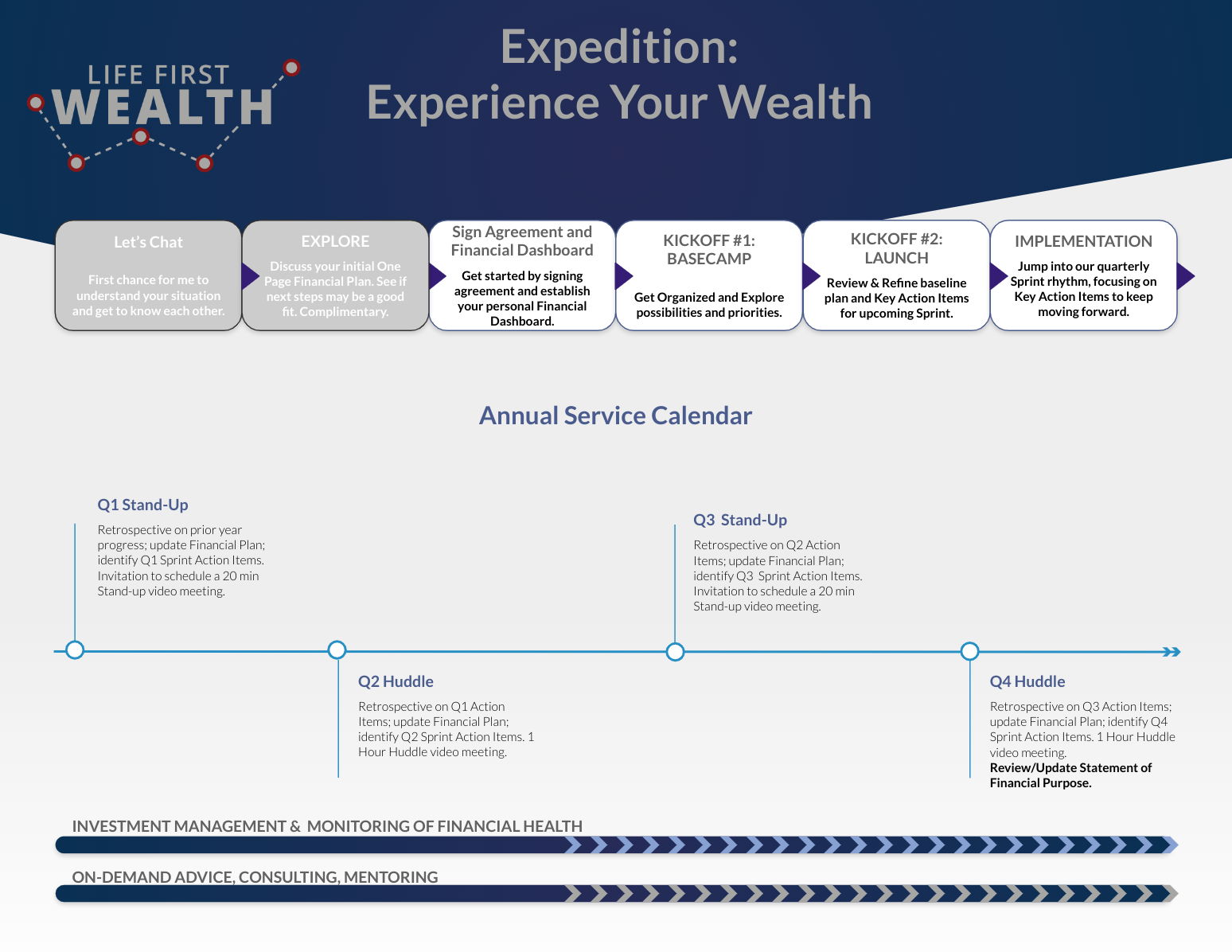

- No Straight Lines in Life. We like to say (over and over) there are no straight lines in life. So why would you plan like it? We believe in the power of approaching financial planning in our Agile Life Planning System, that combines principles from Agile software development world with the best practices of financial planning. This means we are collaborative together throughout the process and continually looking for ways to improve and iterate as things change over time. By focusing on successively highest priority items in short achievable sprints we can continuously move closer to achieving your best life in tangible ways.

Investment Management

Investments are a key part of an overall wealth plan and only work when integrated into a well developed plan (there's a reason we don't offer investment management as a stand-alone service). Making sure you are aligned with a particular financial advisor's investment philosophy is key to making sure you find a good fit. We respect the market's ability to price securities efficiently and believe in the foundations of: diversification, long-term, and purpose (give every dollar in the portfolio a job!). Simple > Complex. Avoid over complicating things where you can. There is enough complexity in our finances let alone our lives to add anymore than we have to. Simplicity also allows for you to be more agile in your investments as things change over time to align with iterations of the plan. In addition we create a systematic portfolio across all accounts via the following:

- Customized portfolio.

- Specific risk management based on your unique risk tolerance (how you feel about the ups and downs) and risk capacity (ability to take on risk based on time-horizon and specific goal for the money).

- Implementation via evidence and research-based, systematic investment tools.

- Opportunistic rebalancing.

- Tax smart via tax-loss harvesting and tax-efficient asset location across different account types.

Just like planning, we believe that investment management isn't about throwing investments over the fence to the advisor, but about being collaborative at each step:

- Asset Allocation - The slicing of the portfolio between asset classes like stocks and bonds. Research has shown that this drives the majority of returns (and the ups and downs along the way). This is about trade-offs between potential returns and portfolio drops. The key is to get this right first and foremost and let the markets do their job to fund your life.

- Investment Style - We start by building a core foundation around low cost, index funds we can use to match the asset allocation. Then we add styles of systematic investment approaches that historical evidence has shown can potentially increase returns to tilt the likelihood of higher returns over the long term in your favor.

- Fine Tuning - We customize your portfolio to align with specific goals (or even restrictions) that you may have like Socially Responsible Investing or avoiding investments that include specific countries.

- Concentration - Managing concentration (having a large percent of your investments in one company like many do through stock-options) is a key piece of our approach as well. We'll work with you on how to balance your belief in your company vs. diversification to ensure you can stay on track with the rest of the portfolio.