When clients first meet me at LifeFirst Wealth, many expect our conversation to revolve around investment returns, tax strategies, and estate planning mechanics. These are certainly important components of comprehensive financial planning, but they often miss the heart of what wealth really means to families. These are just tools to accomplish something much more important.

The Pick Two Exercise

Here’s a simple but profound exercise that can help you drill down to what is most important to you really quickly. I call it "Pick Two." Here's how it works:

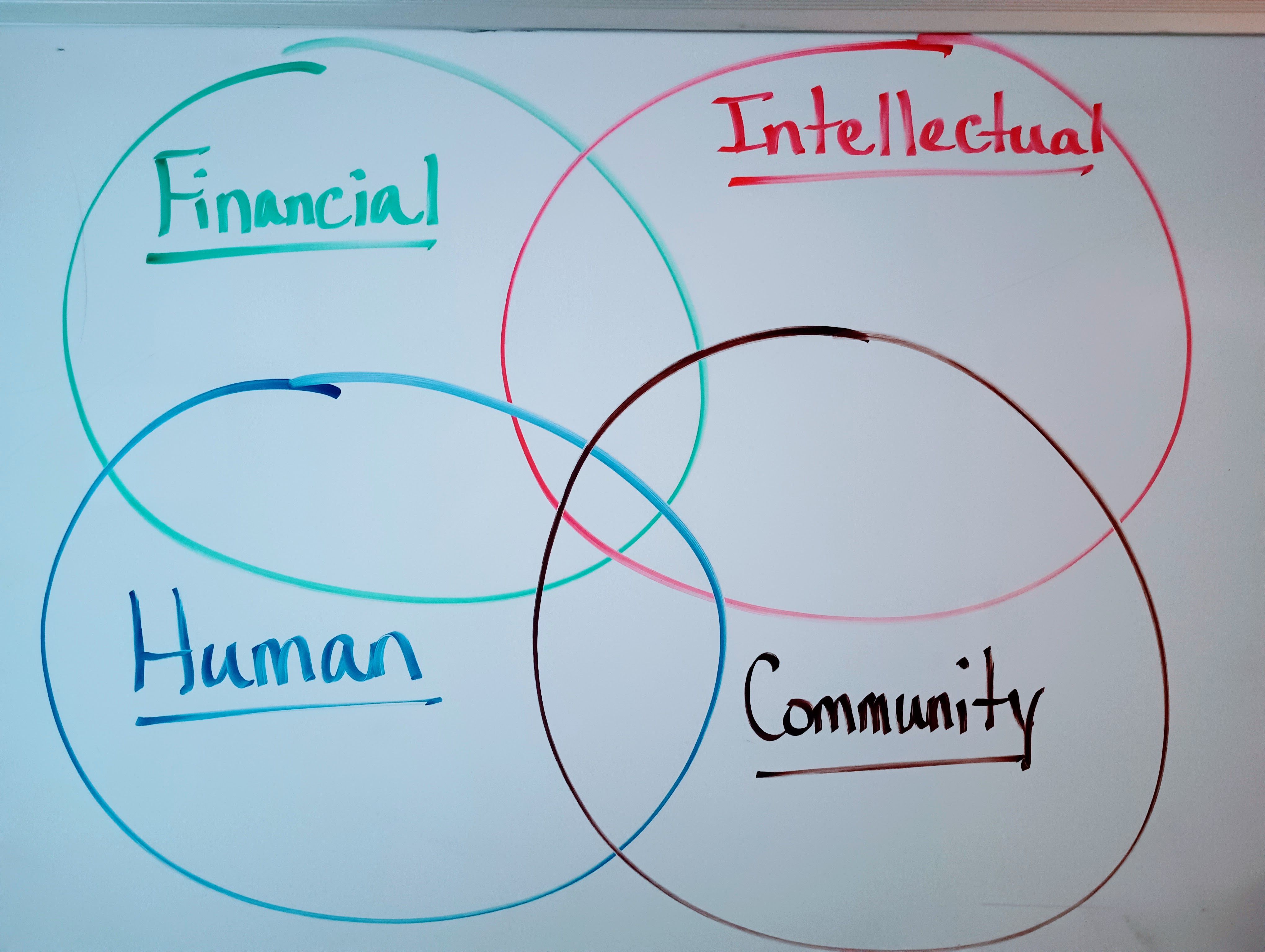

You have four categories of Assets in your life that you manage, spend time and focus on.

- Financial Assets: The traditional focus of wealth management—houses, investments, retirement accounts, cash, etc.

- Human Assets: The elements that make us who we are—faith, family, health, time, relationships, character, and values.

- Intellectual Assets: The accumulated wisdom, knowledge, skills, and expertise we've developed throughout our lives.

- Community Assets: Our connections to the world around us—school groups, neighborhoods, religious communities, public service relationships, etc.

Looking at that diagram, ask yourself, "If you could only share two of these to your children and future generations, which two would you choose?”

What People Choose

Based on experience, I’m guessing that you chose some combination of Human and Intellectual, or Human and Community.

Isn’t it interesting that most advisors spend all of their time talking about financial assets when the things that matter most to us as humans don’t relate directly to money? While we spend countless hours managing our financial resources (some studies have shown around 260 hours per year for a DIY Investor, enough to watch all three of The Lord of The Rings extended versions 22.5 times!) most of us inherently understand that money itself isn't the legacy we most want to leave behind.

These conversations highlight a fundamental truth that we at LifeFirst Wealth that has shaped LifeFirst from the very beginning: Financial assets are ultimately a means to an end, not the end goal itself.

Aligning Financial Planning with True Priorities

The disconnect between what traditional financial advisors focus on and what clients truly value presents both a challenge and an opportunity. At LifeFirst Wealth, we've built our practice on bridging this gap.

When clients reveal that Human assets matter most to them, we can explore questions like:

- How can your financial resources support family gatherings that strengthen relationships?

- What experiences might help transmit your core values to the next generation?

- Are there health investments that would enhance your quality of life and longevity?

For those prioritizing Intellectual assets, we might discuss:

- Education funding strategies that align with your family's learning values

- Investments in ways to foster a love of learning within your family

And for Community assets:

- Strategic charitable giving that maximizes impact in areas you care about

- How to include kids into your charitable giving

- Creating the time and space in your life to be a part of community initiatives that reflect your values

Living Richly Today While Planning Purposefully

This approach transforms wealth management from a purely numbers-focused exercise into something more meaningful: using your life's work to invest in what matters most to you.

The question becomes not just "How much money can you build up in my accounts?", but "How do we take your financial assets and use them to invest in the things that matter most to you and your family?"

One client summed it up pretty well: "I’ve never had these kinds of conversations with my former advisor, it was just about investments, this is totally different.”

A Different Kind of Conversation

When we begin with the Pick Two exercise, our planning conversations take on a different tone. Financial decisions are evaluated not just for their economic efficiency but for how well they support the transfer of Human, Intellectual, and Community assets.

This approach doesn't diminish the importance of proper financial planning—quite the opposite. It elevates financial planning by connecting it directly to your deepest values and priorities, making sure it feeds them.

At LifeFirst Wealth, we believe this is what real financial advice is: using your financial assets as tools to build, live, and share the things that matter most to you.

What would you choose if faced with the Pick Two exercise? And how does that change how you look at your current and future financial picture?